Twitter files for IPO: Here’s What We Know So Far About Twitter’s IPO

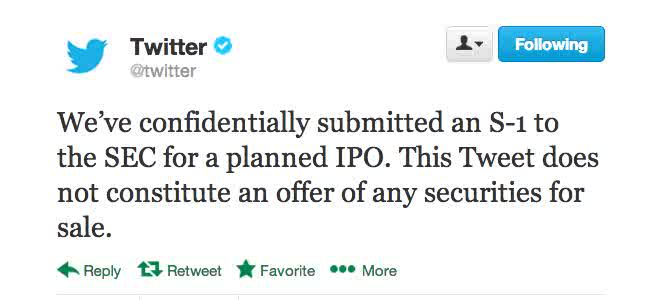

It’s official: Twitter is going public.

The social media company announced Thursday that it has filed plans for an IPO with the Securities and Exchange Commission, ending months of speculation about its intentions to sell stock on the public markets.

The company, which has 200 million members, disclosed the filing in a tweet. Analysts say Twitter could be valued at up to $10 billion, based on trading on secondary exchanges, in what will surely be the biggest tech IPO since Facebook’s $16 billion offering in May 2012. Goldman Sachs is likely the the lead underwriter, Bloomberg News reported.

Twitter used a provision of the JOBS Act that allows companies with less than $1 billion in revenue to file plans for an IPO in secret. The law, passed in 2012, is meant to spur public offerings by smaller companies. The confidential filing means regulators can now review Twitter’s documents without the company having to disclose its financials to the public.

The announcement of an IPO ends what had been one of the biggest questions in tech. For months, Twitter CEO Dick Costolo has steadily refused to tip his hand on whether the company would go public. He declined to grant any interviews after giving a keynote presentation on leadership at TechCrunch’s Disrupt conference in San Francisco Monday.

And, in an interview with Katie Couric at the Aspen Ideas Festival in June, he insisted that making money was not a priority.

“We think of revenue like oxygen,” he said at the time. “It’s necessary for life, it’s vital to the health and success of the business, but it’s not the purpose of life. You don’t get up in the morning and say, ‘I’ve got to get enough oxygen.’”

Still, the company is expected to make $582.8 million in global ad revenue in 2013 and close to $1 billion next year, according to eMarketer. Analysts also say Twitter has massive room for growth in local advertising, an area that has proven to be a growth driver for Facebook.

Publicly traded investment funds that hold a stake in Twitter spiked following the announcement. GSV Capital, whose Twitter shares make up 15 percent of the fund, rose 17 percent in after-hours trading.

Big questions remain, of course, including when exactly Twitter will go public. Many analysts predict it will begin selling stock later this year to take advantage of increased demand for IPOs in the U.S. A total of 131 companies have gone public this year, a 44 percent increase from the same period in 2012, according to research firm Renaissance Capital.

It’s also unclear whether Twitter will list the IPO on the New York Stock Exchange, or the Nasdaq, which has come under fire after its handling of Facebook’s IPO and the Aug. 22 “flash freeze” that halted trading for three hours.

More coverage of Twitter’s IPO:

Avinash Kaushik: Why Marketers Should Be Ecstatic About Twitter’s IPO

Marcos Galperin: In Favor of IPOs and the Public Markets

Photo: Getty Images

Read More: Linkedin